For many clinics, a Medicare audit feels like it comes out of nowhere. Claims were paid, months passed, and suddenly, there’s a request for records, documentation, and explanations. In reality, most audits are not random. They’re triggered by patterns—small billing mistakes that repeat quietly until they flag Medicare’s monitoring systems.

Understanding these triggers isn’t about fear; it’s about prevention. Clinics that know what Medicare looks for can correct issues early, protect revenue, and reduce audit exposure.

Below are the most common billing mistakes that lead to Medicare audits, along with practical ways clinics successfully avoid them.

1. Consistent Upcoding Without Clinical Justification

One of the fastest ways to draw audit attention is billing higher-level Evaluation & Management (E/M) codes without documentation to support them.

Medicare closely tracks:

- Unusually high use of level 4 or level 5 visits

- Patterns that don’t align with specialty norms

- Providers who bill at higher levels more often than their peers

How clinics avoid it

- Document medical decision-making clearly, not just exam findings

- Avoid “template inflation” where EHR auto-populates details not performed

- Train providers to select codes based on clinical complexity, not time pressure

2. Incomplete or Cloned Documentation

Documentation that looks identical across visits is a major red flag.

Medicare auditors look for:

- Repeated language across multiple encounters

- Copy-paste notes without patient-specific updates

- Missing links between diagnosis and services billed

How clinics avoid it

- Use templates as a starting point, not a final note

- Require providers to update assessment and plan sections meaningfully

- Perform internal note reviews before claims submission

3. Billing Services Not Supported by Medical Necessity

Medical necessity is one of the most common audit findings.

Examples include:

- Diagnostic tests without documented symptoms

- Procedures billed without a conservative treatment history

- Frequency of services exceeding Medicare guidelines

How clinics avoid it

- Tie every billed service to a documented complaint or diagnosis

- Reference Medicare coverage policies when ordering tests

- Review utilization patterns quarterly, not annually

4. Incorrect Use of Modifiers

Modifiers are essential—but misused modifiers are audit magnets.

Common problems:

- Overuse of modifier -25 on E/M visits

- Incorrect modifier -59 usage to bypass bundling edits

- Applying modifiers without clear documentation

How clinics avoid it

- Document separately identifiable services clearly

- Use modifiers only when criteria are fully met

- Educate billing staff on payer-specific modifier rules

5. Billing Incident-To Services Improperly

Incident-to billing is frequently misunderstood and often audited.

Medicare requires:

- Direct supervision by a physician

- Established care plans

- Proper documentation of provider involvement

How clinics avoid it

- Confirm supervision requirements are met on the date of service

- Avoid incident-to billing in settings where it’s not allowed

- Audit incident-to claims internally for compliance

6. Inconsistent Diagnosis Coding

Auditors compare diagnosis codes to:

- Treatment plans

- Frequency of visits

- Services rendered over time

Red flags include:

- Diagnoses that don’t change across long treatment periods

- Codes that don’t justify procedures billed

- Mismatch between provider notes and claim data

How clinics avoid it

- Update diagnoses as patient conditions evolve

- Ensure ICD-10 codes support CPT codes

- Avoid default or “favorite” diagnosis selections

7. High Denial or Appeal Activity

Ironically, repeatedly appealing denials can also attract scrutiny. A pattern of:

- Frequent claim corrections

- High overturn rates

- Multiple post-payment adjustments

can signal underlying billing weaknesses.

How clinics avoid it

- Analyze why claims are denied instead of repeatedly appealing

- Fix root causes in documentation or coding

- Reduce rework by improving front-end processes

Why Most Audits Are Preventable

The majority of Medicare audits don’t result from fraud. They stem from process gaps, inconsistent documentation, and a lack of internal review.

Clinics that invest in:

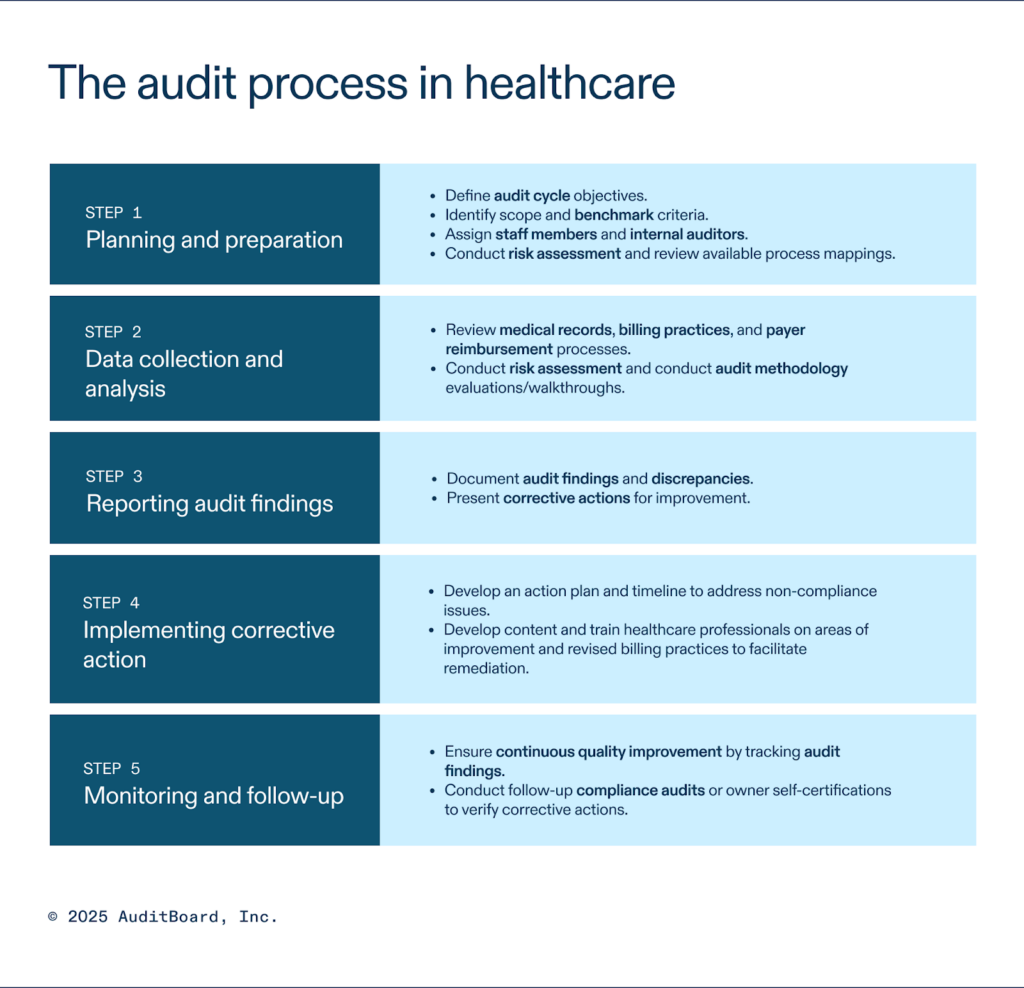

- Routine internal audits

- Provider education

- Billing and documentation alignment tend to reduce audit exposure significantly.

Organizations such as ANR Medical Billing often emphasize that proactive compliance reviews and ongoing provider education are far more effective than reacting after an audit notice arrives.

Final Thoughts

Medicare audits are rarely about one bad claim. They’re about patterns that develop over time. By understanding common triggers—and addressing them early—clinics can protect both compliance and revenue.

The goal isn’t just to pass an audit. It’s to build a billing process that doesn’t invite one in the first place.