The Strategic Role of the CFO in Modern Business

The Chief Financial Officer position underwent significant changes during the past ten years. The CFO dashboard can be used to focus on accounting and compliance but now leads the development of business strategy and long-term value creation. The contemporary CFO executes financial reporting duties while handling the management of financial operations and technological systems integration. The role of CFOs has evolved to include new duties which move past financial accuracy to encompass sustainable growth management and strategic investment direction and risk oversight.

The organization encounters fresh operational problems because of the change in responsibility. The Chief Financial Officer needs to combine multiple data sources for making fast and precise decisions during times of market instability. The required level of analysis requires more than manual spreadsheets and static financial reports. Organizations need modern financial tools which provide real-time financial data to achieve financial health during their digital transformation process.

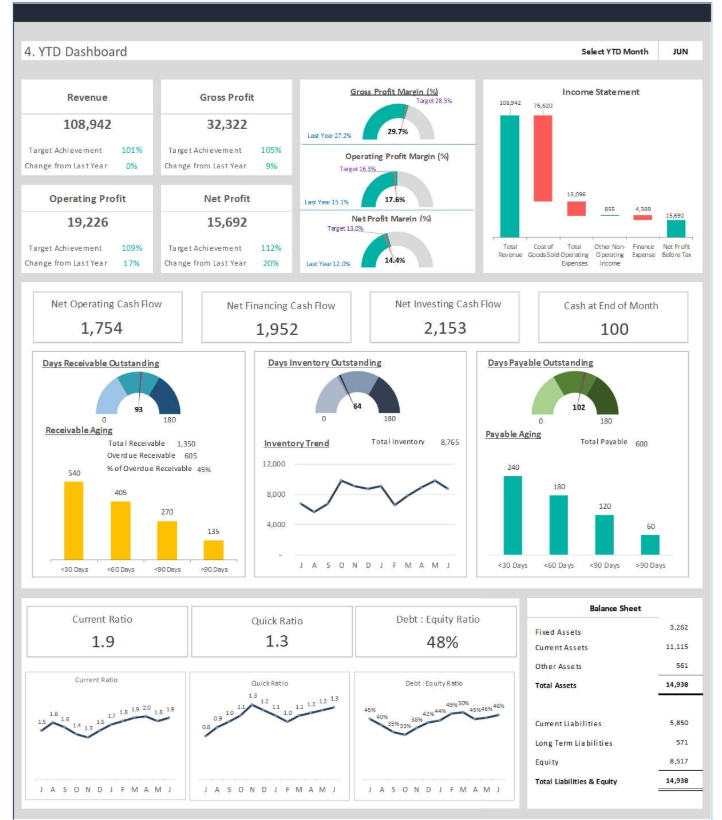

A CFO dashboard serves as a visual tool which presents financial data to help executives make better decisions. The dashboard provides essential information to help executives make better decisions. A CFO dashboard serves as a digital platform which unifies essential financial data into a single visual interface for easy information retrieval. The system functions as a core management system which CFOs use to monitor performance indicators and discover emerging market patterns and assess financial outcomes of business activities. The dashboard collects information from multiple data sources which include ERP systems and accounting software and CRM platforms and operational databases. The system delivers complete financial visibility of the organization through its unified functionality.

Core Metrics Every CFO Dashboard Should Include

A CFO dashboard requires financial and operational data to work properly while using strategic performance indicators for its correct structure. The organization achieves complete financial transparency through these essential performance indicators which also help track strategic goals. The evaluation process requires complete evaluation of revenue performance together with profitability indicators. The CFO must track revenue patterns together with gross margin and net income results. The evaluation of business model effectiveness requires knowledge about revenue origins and product/service delivery expenses and financial performance outcomes.

Cash flow and liquidity metrics have the same level of significance. A profitable business will experience financial problems when its cash management system fails to operate effectively. The display of inflows and outflows and available cash on dashboards allows CFOs to maintain liquidity control while ensuring the organization meets its current financial obligations. Real-time cash position monitoring enables organizations to make better investment choices and financing decisions and risk management strategies.

The operational efficiency ratios including operating expense ratios and EBITDA help organizations understand their cost management and business performance better. The financial metrics help CFOs track how revenue transforms into operating profit while ensuring that all company expenses align with strategic objectives. The indicators allow CFOs to track performance which enables them to find operational improvements that boost profit margins.

Working capital management functions as an essential business element. The company can stop resource waste and achieve a balanced cash cycle through its monitoring of accounts receivable and accounts payable and inventory turnover process. The dashboard system enables better detection of financial patterns and cash deficit prevention and financial resource optimization.

Designing a CFO Dashboard for Strategic Impact

A CFO dashboard achieves its effectiveness through both the selection of displayed metrics and the technical platform and design elements that support it. The first step to achieving success requires selecting suitable tools. The selection of dashboard tools for CFOs depends on business size and complexity because they can use Excel dashboards or business intelligence tools such as Power BI and Tableau or enterprise resource planning system dashboards. The selected platform requires alignment with existing organizational data infrastructure to achieve seamless data integration and automated system operations.

The selection of a platform represents the first essential step which leads to design as the following priority. A strategic CFO dashboard needs to show information in simple ways by using basic visual displays. The system design needs to display performance metrics through simple methods which enable users to understand them right away. The system needs to display fundamental metrics at its highest level, but users should be able to find additional detailed information through designated sections. Users can find essential data and spot upcoming issues through the combination of color coding with trend lines and indicators.

The process of customization serves as a fundamental component which enables both relevance and audience engagement. The information needs of various stakeholders demand separate dashboard configurations for each group. The CFO requires financial ratios and cash forecasts at a detailed level, yet board members need to see high-level summaries through visual storytelling methods. The dashboard functions as an organizational strategic communication tool because it lets users build customized views which fulfill their individual needs.

Turning Insights into Actionable Strategy

A CFO dashboard functions as a reporting system which enables strategic business decisions through its operational capabilities. The real-time access to essential data through dashboards allows CFOs to identify financial risks and opportunities when they first emerge. Leadership uses their foresight to detect upcoming challenges which enables them to stop their expansion and seize emerging opportunities.

The CFO can determine the source of declining gross margins through dashboard data which shows a continuous downward trend in gross margins. The CFO needs to determine if higher production costs or market price competition or operational production problems are responsible for the decline in gross margins. The organization can apply this understanding to modify its pricing approach and adjust supplier agreements and automation investments for achieving margin recovery. The CFO would use a consistent surplus of cash reserves to search for investment possibilities or debt reduction or shareholder value distribution.

Conclusion

The modern CFO position needs strategic tools which provide instant data access and strong analytical capabilities and simple communication channels. A CFO dashboard that is well-designed will meet all these needs. The platform enables CFOs to access a single platform which converts intricate financial information into interactive dashboards for enhanced decision-making capabilities.

The clarity needed to make strategic decisions comes from tracking core metrics which include revenue and profitability and cash flow and operational efficiency and budget performance. When supported by the right technology and thoughtful design, a CFO dashboard becomes more than a reporting tool; it becomes a driver of financial health, organizational alignment, and sustainable growth. Bizinfograph offers ready-to-use dashboard templates on Finance, Sales, HR and Manufacturing.